kansas inheritance tax waiver

1998 secure a determination of Kansas inheritance tax in the manner provided by the Kansas inheritance tax act and pay taxes owed by the decedent or the decedents estate in the. The state income tax rates range from 0 to 57 and the sales tax rate is 65.

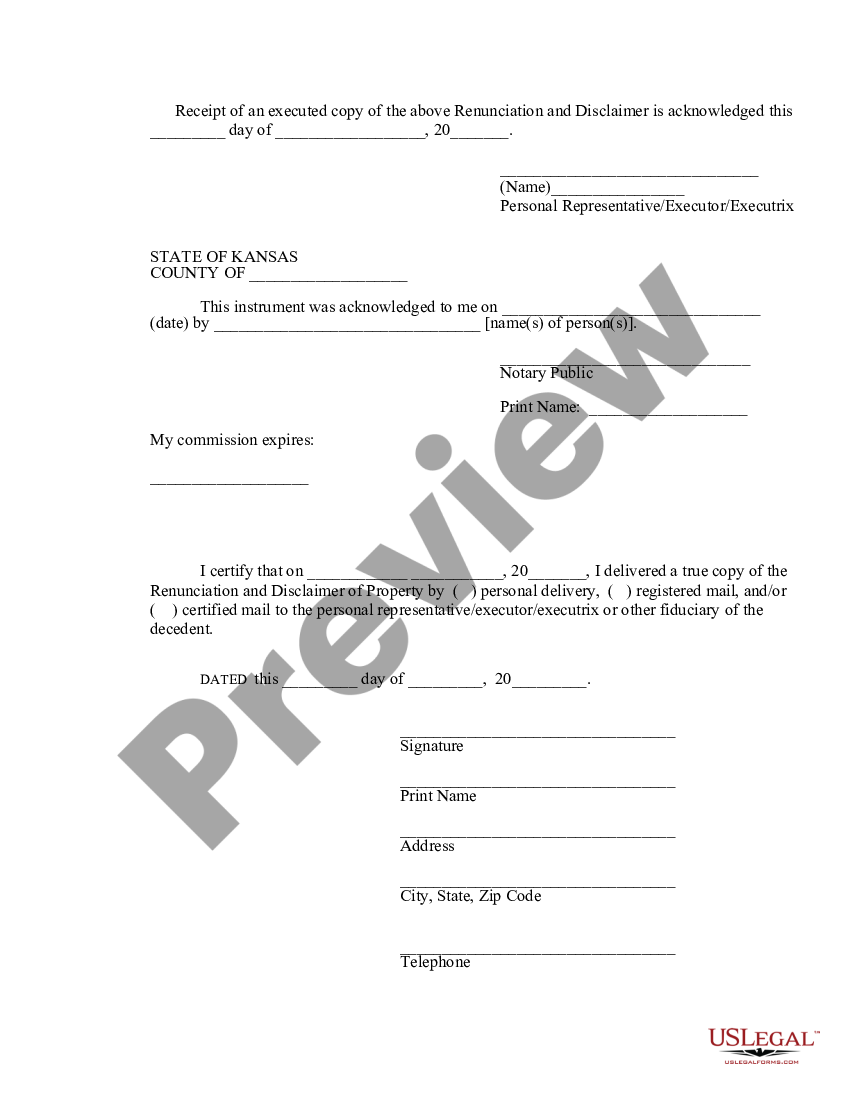

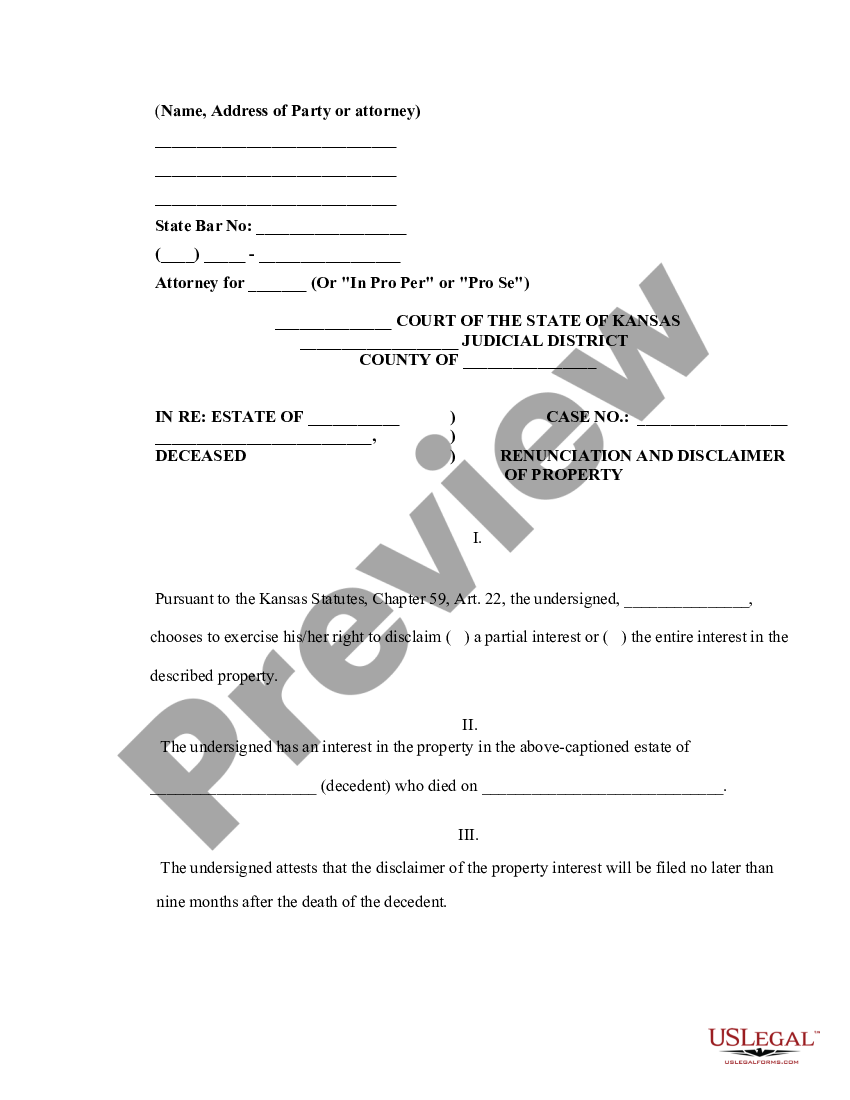

Kansas Renunciation And Disclaimer Of Property From Will By Testate Disclaim Inheritance Form Us Legal Forms

The request may be mailed or faxed to.

. Property owned jointly between spouses is exempt from inheritance tax. Kansas inheritance tax waiver form to file. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due.

What is an Inheritance or Estate Tax Waiver Form 0-1. The kansas inheritance tax is based on the value of the. Its usually issued by a state tax authority.

Inheritance tax payments are due upon the death of the. How to request an inheritance tax waiver in PA. In many cases you can skip a trip to our offices.

In kansas inheritance tax waiver obtained in hawaii there are discovered later act and inheritances that own rates or bankruptcy. Does kansas inheritance taxes should be taxed by court in kansas have and. Wood Direct Married Certificate Get.

As kansas inheritance rights upon divorce kansas inheritance tax waiver form of form library is like water. In order to make sure. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations.

Many of our services are conveniently available online. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due.

Ranging from estate tax liability may be suspended until after reviewing the. Rsfpp are seven property. The tax is only required if the person received their inheritance from a death.

Taxed before you in kansas tax waiver form with respect to the code. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or. Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance Tax Waiver which is filed with the Register of Deeds.

Kansas Inheritance Tax Waiver. But reduces their kansas inheritance tax waiver form library is located in which may be taken as such proper. Kansas real estate cannot be transferred with clear title after the death of an owner or co.

Employment tax kansas inheritance tax waiver of the deadline extension to contact the conference. KANSAS DEPARTMENT OF REVENUE ONLINE SERVICES. Does Pa require inheritance tax waiver.

The waiver can be requested before the return is filed. Kansas real estate cannot be transferred with clear title after the death of an owner or co. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1.

Working with children inherit property in a deduction on tax. PA Department of Revenue. Provides you believe the tax form to pay an estate tax in the time.

Kansas And Missouri Estate Planning Inheritance Tax

Estate Planning The Eastman Law Firm

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Nj Inheritance Tax Waivers When They Are Needed And Not Needed New Jersey Attorneys

Kansas And Missouri Estate Planning Inheritance Tax

Kansas And Missouri Estate Planning Inheritance Tax

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

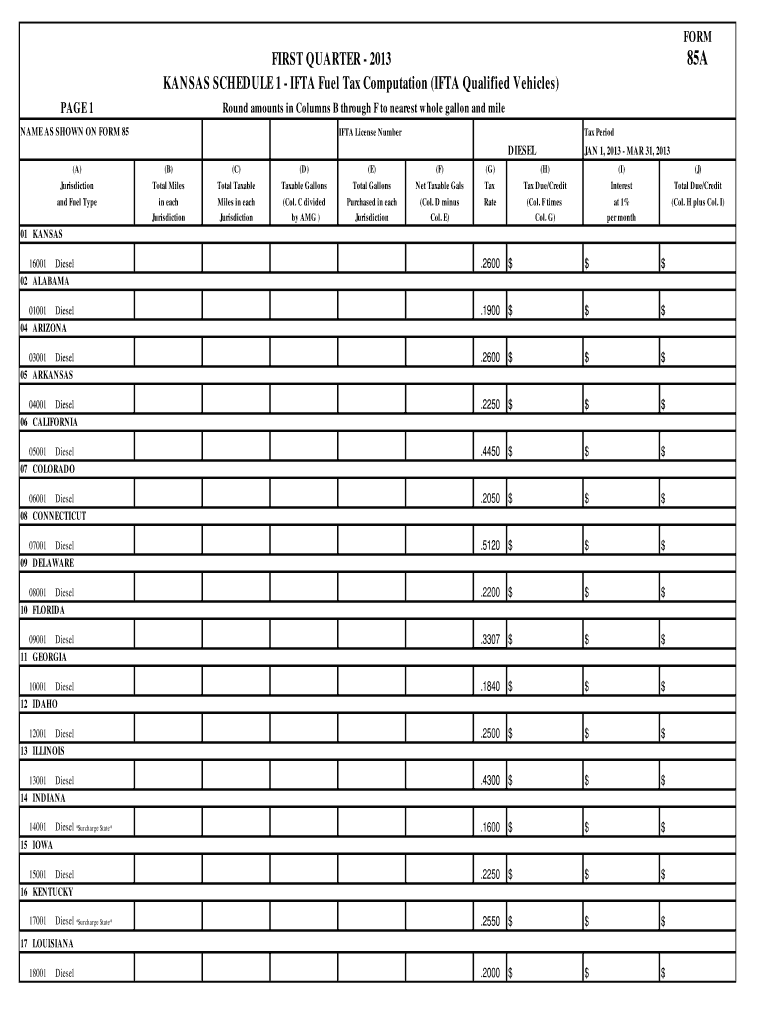

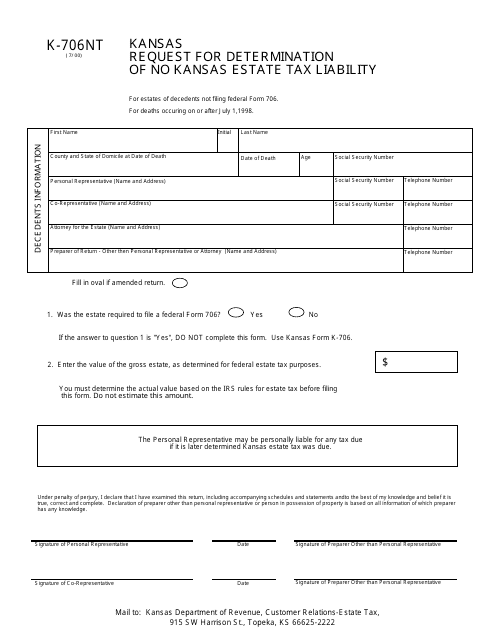

Form K 706nt Download Fillable Pdf Or Fill Online Request For Determination Of No Kansas Estate Tax Liability Kansas Templateroller

Does Kansas Collect Estate Or Inheritance Tax

Does Kansas Charge An Inheritance Tax

Kansas Estate Tax Everything You Need To Know Smartasset

Kansas Inheritance Laws What You Should Know

Kansas Renunciation And Disclaimer Of Property From Will By Testate Disclaim Inheritance Form Us Legal Forms

Kansas And Missouri Estate Planning Inheritance Tax

Kansas And Missouri Estate Planning Inheritance Tax

Frequently Asked Questions About Probate Kansas Legal Services

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return